In 2015, the film The Big Short brought a complicated financial story to the big screen. Directed by Adam McKay and based on the book by Michael Lewis, the movie follows a group of investors who predicted the housing market crash of 2008. While most people lost money during the crisis, a few individuals made huge profits. These investors saw the danger coming and bet against the housing market. Their bold moves led to massive financial gains. But who made the most money in The Big Short? Let’s break it down and find out.

What Was the Big Short?

The term “The Big Short” refers to a massive bet against the U.S. housing market. In the early 2000s, housing prices were rising quickly. Banks gave out risky loans to people who could not afford them. These loans were packaged into investments called mortgage-backed securities. On the surface, these looked like safe investments. But in reality, they were full of bad loans.

A few investors realized the housing market was in trouble. They used a financial tool called a credit default swap (CDS) to bet against these risky mortgage investments. This strategy was risky, but if the market collapsed, they would make a lot of money. When the housing bubble finally burst in 2007 and 2008, these investors earned billions.

The Main Players in The Big Short

The movie highlights four main groups who made big bets against the housing market:

- Dr. Michael Burry (played by Christian Bale)

- Mark Baum’s team (based on Steve Eisman, played by Steve Carell)

- Charlie Geller and Jamie Shipley (based on real investors Charlie Ledley and Jamie Mai)

- Jared Vennett (based on Greg Lippmann, played by Ryan Gosling)

Each group played a different role, and each made money in their own way. Let’s look at each one and how much they made.

Dr. Michael Burry

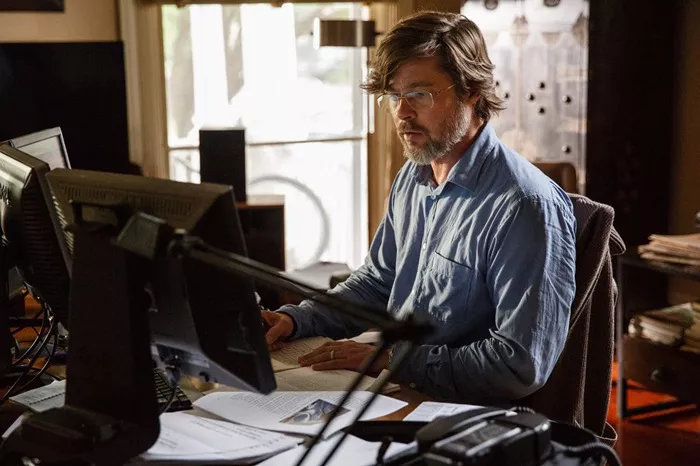

Dr. Michael Burry was one of the first people to see the housing market was a bubble. He ran a hedge fund called Scion Capital. Burry studied thousands of mortgage documents. He realized that many of the loans were likely to default. In 2005, he started buying credit default swaps against subprime mortgage bonds.

Many of his investors were unhappy. They didn’t understand what he was doing. But Burry stayed confident. He believed the crash was coming. And he was right. When the market collapsed, Burry’s fund made around $750 million for his investors and $100 million for himself.

Key Facts About Michael Burry:

- Founded Scion Capital in 2000

- Predicted the housing crash as early as 2005

- Earned $100 million personally

- Made around $750 million for his investors

Mark Baum (Steve Eisman)

Mark Baum is a fictional name for Steve Eisman. He worked at a firm called FrontPoint Partners. When Jared Vennett (Greg Lippmann in real life) introduced him to the idea of betting against the housing market, Eisman did his own research. He found out how bad the mortgage system really was.

Eisman and his team bought credit default swaps, just like Burry. He was angry about how corrupt the system had become. While making money, he also wanted to expose the truth. Eisman’s team made roughly $1 billion for their firm. His personal earnings are not exactly known, but he made millions.

Key Facts About Steve Eisman:

- Worked at FrontPoint Partners

- Earned around $1 billion for his firm

- Was driven by both profit and moral outrage

- Likely made several million dollars personally

Charlie Geller and Jamie Shipley (Charlie Ledley and Jamie Mai)

These two young investors started Cornwall Capital with just $110,000. They were not big players in Wall Street. But they were smart and curious. When they discovered how bad the housing market was, they wanted to get involved.

With help from Ben Rickert (based on real person Ben Hockett), they got access to buy credit default swaps. Their bet was smaller than the others, but the payoff was huge. By the time the market crashed, they turned their $110,000 into $80 million.

Key Facts About Cornwall Capital:

- Started with only $110,000

- Made around $80 million

- Were underdogs in the world of finance

- Proved that even small investors could win big

Jared Vennett (Greg Lippmann)

Jared Vennett, based on Greg Lippmann of Deutsche Bank, was one of the first to understand Burry’s idea. He saw a chance to make money by selling the idea of shorting the housing market to other investors. He helped people like Eisman get involved.

While the movie focuses more on the others, Lippmann also made a lot of money. He earned tens of millions by acting as the middleman. His bank made huge profits too.

Key Facts About Greg Lippmann:

- Worked at Deutsche Bank

- Helped spread the idea of shorting the market

- Earned tens of millions personally

- Made large profits for his bank

So, Who Made the Most Money?

Now, let’s compare the numbers:

- Michael Burry: $100 million personally, $750 million for investors

- Steve Eisman: Unknown personal earnings, $1 billion for his firm

- Cornwall Capital: $80 million total

- Greg Lippmann: Tens of millions personally, large profits for Deutsche Bank

In terms of personal profit, Michael Burry appears to have made the most money directly. He earned around $100 million from his investment. His bold decision and early action gave him a huge advantage. While Steve Eisman’s team made more money overall, Burry kept more of the profits for himself.

Why Did They Succeed?

These investors succeeded because they saw what others ignored. They studied the data carefully. They were not afraid to go against the crowd. Most people believed the housing market was safe. But these investors asked hard questions and looked deeper.

They also had the courage to stick to their beliefs. Even when others doubted them, they stayed focused. That kind of patience and determination is rare in finance.

Final Thoughts

The Big Short tells a powerful story about risk, reward, and truth. The people who made the most money were not just lucky. They were smart, brave, and willing to challenge the system. Michael Burry, Steve Eisman, Charlie Ledley, Jamie Mai, and Greg Lippmann all played different roles. But they shared a vision: the belief that something was wrong and the guts to act on it.

Michael Burry may have made the most money personally, but all of them changed how we look at Wall Street. Their actions not only brought them fortune but also helped reveal one of the biggest financial disasters in history.